If you’ve been thinking now may be the time to get into the home market, here are two reasons why you might be right:

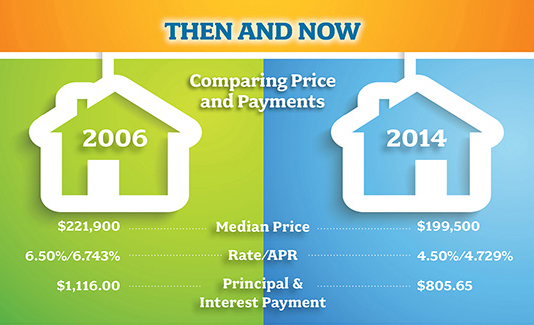

AFFORDABILITY – Compare not just the price but also the rate/APR and principal and interest payment for a median priced home. The combination of lower prices AND lower rates has the potential to cut mortgage loan payments significantly.

OPPORTUNITY – The national median price was $176,900 in October 2012 and $199,500 in October 2013. Rates have headed up, too. If you’re in the market to buy, purchasing at the beginning of these rising trends may prevent further increases in your monthly payment.

Are you ready to take action? Inventory has fallen from previous levels, and in some markets with scarce listings, bidding wars have returned. You can be prepared to act quickly by obtaining pre-approval for your loan. Sellers will know you’re serious, and you’ll have a good idea of the amount you can afford based on payments and costs.

While obtaining a loan may be a more involved process than it was back in 2006, a little bit of knowledge and preparation can help you along the road to homeownership. Reach out today so we can get you started.

This is an educational example only and is not an offer to lend. Actual current rates are subject to change at any time. Payments shown are for principal and interest on a 30-year, fixed-rate loan. Loan amount assumes a 20% down payment. APR is calculated using closing costs of 3%. Actual fees can be less. Owning a home includes other expenses such as taxes, insurance, maintenance, etc. Qualifying for any loan is based on individual circumstances including but not limited to income, assets, debts and credit history.